The Bank of England says it expects the UK economy to grow by 0.75% in 2025, down from a previous forecast of 1.5%.

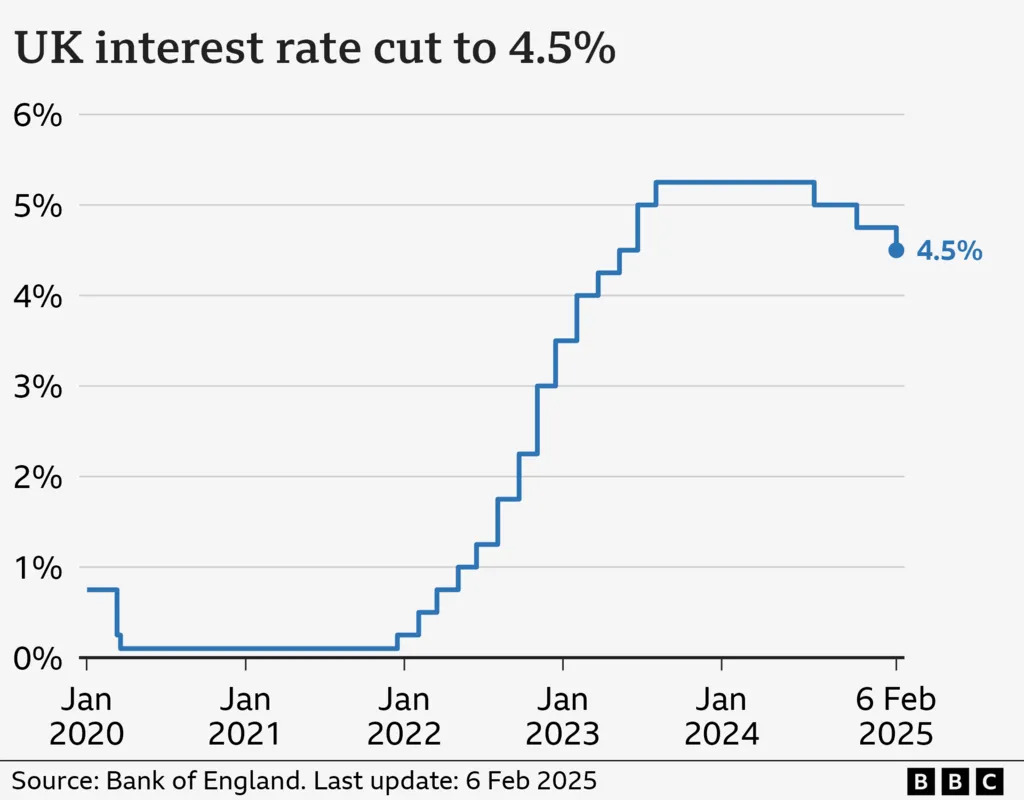

The Bank of England has cut interest rates for the third time in just under a year.

Policymakers at the Bank have opted to reduce interest rates to 4.5% yesterday.

Rates sat at 4.75% after being cut by 0.25% in November 2024. They were then kept the same in December.

But there was a notable difference of opinions among the nine-member committee making the decision on rates.

While seven voted for a cut from 4.75% to 4.5%, two wanted a bigger cut to 4.25%, reflecting growing uncertainty for the UK economy.

The decision to rate the rates could lead to cheaper borrowing costs for things like mortgages and loans, but also lower returns on savings.

The impact this could have on Gibraltar's property market could be huge. Following a slow year in 2024 where prices dropped by an estimated 10-15%, we have noticed a sharp upturn in activity since the start of interest rate cuts towards the end of last year. Slightly lower property prices coupled with reduced mortgage rates mean Gibraltar properties are now more affordable than they have been for many years.

This is good news for those looking to get a foot on a difficult property ladder and good news for investors who have seen returns after expenses cut to the bone.

2025 seems to have started off very well in the sales market and this good news should see this positive activity grow throughout the year.

Will there be further cuts to come? Next MPC meeting 20th March. Watch this space.....