Gibraltar faces many pressing financial challenges. One of the worst is the parlous position of those aged under 30, known the world over as Gen Z.

For the first time, a generation will be significantly poorer than the one before.

This is well known, but the fact that the most watched TED talk of 2024 was called how the US is destroying young people's future perhaps underlines how this debate is shifting gear.

New York University marketing professor Scott Galloway delivers a stinging rebuke that will resonate with young people, and his appraisal is as relevant to Gibraltar as it is the US.

The problem faced by a typical twenty-something is daunting: how to buy a house and pay rent while also building an emergency fund and future savings.

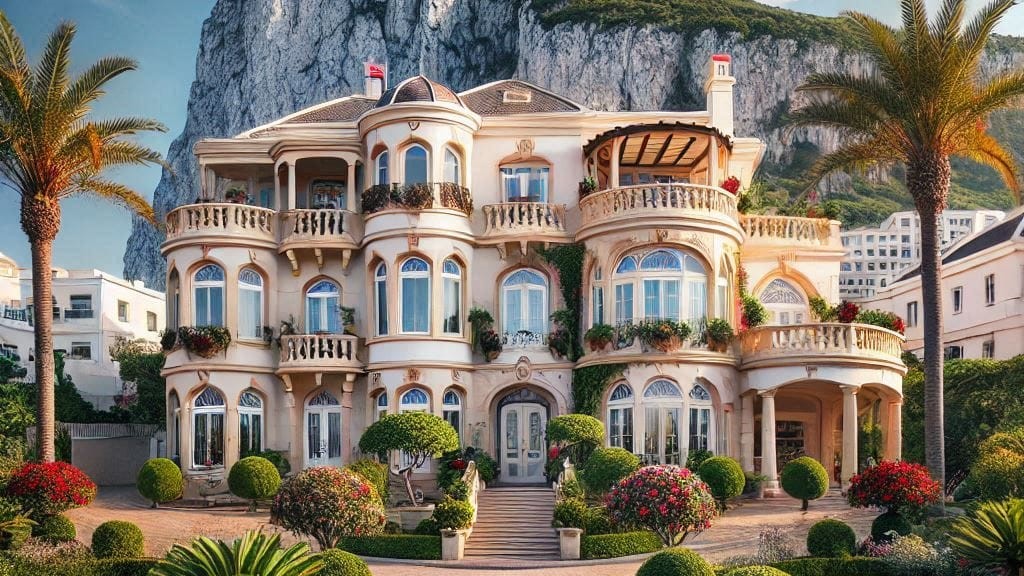

The figures are sobering. First-time buyers in Gibraltar put down an average £55,372 to secure a home, a daunting amount to save - and especially when the average Gibraltar salary for those aged 22 to 29 is £29,195.

A red-hot rental market makes the challenge harder. Rents have surged by about 10 to 15 per cent this year alone, taking the average monthly cost to £1,884, says the PropertyGibraltar website.

Buying your first home has always been hard. But never this hard.

When I stepped on to the property ladder in December 2012, buying a two-bed flat in London aged 30, the average house price was 6.2 times the average salary. Today the ratio in Gibraltar is closer to 12.

Reports indicate that the proportion of under-35s in Europe living with their parents had risen from 26 per cent in 2000 to 39 per cent by 2022. Although data specific to Gibraltar is harder to come by, it's likely to tell a similar story.

The blame seems to be the 'costly housing, repeated economic shocks and stagnating living standards' that have defined our 21st century financial lives.

The figures are likely to have worsened in recent years with house prices continuing their relentless climb.

What can stop, stall or even reverse this trend of generational impoverishment within our own territory?

Perhaps Gibraltar’s good record on providing good, affordable housing for first time buyers (such as the recently constructed Hassans Centenary Terraces or the upcoming Chatham Views and Bob Peliza Mews etc) will provide sufficient supply, easing property price pressure. Perhaps the additional tax liability for those owning over 5 properties may put off investors and free up housing stock for the young. However, given the seemingly insatiable demand for housing and the relentless rental returns, neither looks certain.

So, what could be a meaningful solution? Perhaps the obvious answer is that the generation that has more could give to the generation that has less.

There has always been a mechanism for this: death. The number of adults receiving an inheritance over a two-year period rose by 23.5% between 2008-10 and 2018-20. However with people living longer and baby boomers now largely at the point of retirement, there will likely become a more popular mechanism.

The power of gifting

You can, of course, pre-empt death by giving wealth away whilst alive, and be able to appreciate your own acts of generosity.

With no inheritance tax in Gibraltar, there has been little incentive to hand down assets prior to your own demise until now.

Faced with a son or daughter in need of a mortgage deposit today, it makes more sense to gift.

I expect to see an increase in ‘additional’ homes being sold and the proceeds being gifted to offspring. In addition, it was mentioned in July's Budget that HMGoG is looking to implement a “downsizing incentive” for seniors (over 65) which will be the equivalent of the first time home buyer’s allowance for those selling and moving to a smaller property.

This, in turn, could help ease pressure on Gibraltar’s property market. In combination, it could ease the inter-generational wealth gap.

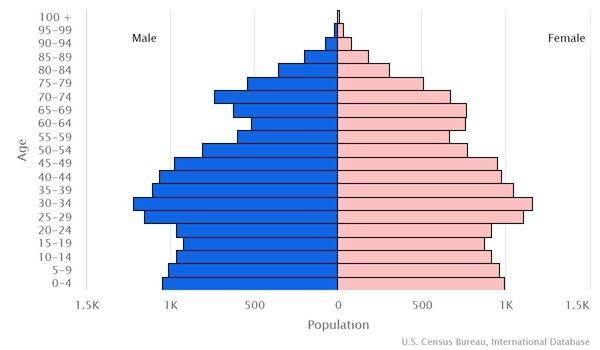

Gibraltar’s population pyramid shows that the most populous age bracket is 30-34. The age that many people will be wanting to get on the property ladder. While the ‘baby boomers’ who hold much of the territory’s wealth are in their late 60s and 70s. An incentive to help this older generation downsize seems the sensible option.

Gibraltar's Poopulation Pyramid (click for source)

There is a growing appetite for more radical thinking. Speaking to senior colleagues and peers in the property industry in Gibraltar and the UK, other than continually building, downsizing is one of the largest factors that can keep the property ladder from surging away from first time buyers.

And bear in mind, downsizing is not a purely selfless act, it also has a more self-indulgent appeal: why delay your acts of kindness until after death? Give now, enjoy seeing it used and ensure your family’s future stability for generations.

Perhaps a bigger downsizing trend will begin from here. And perhaps the most watched TED Talk of 2035 will chart how the Great Wealth Transfer began in 2025.

If you're considering downsizing in the coming year or would laike a general picture of the market moving forward, get in contact with us now: