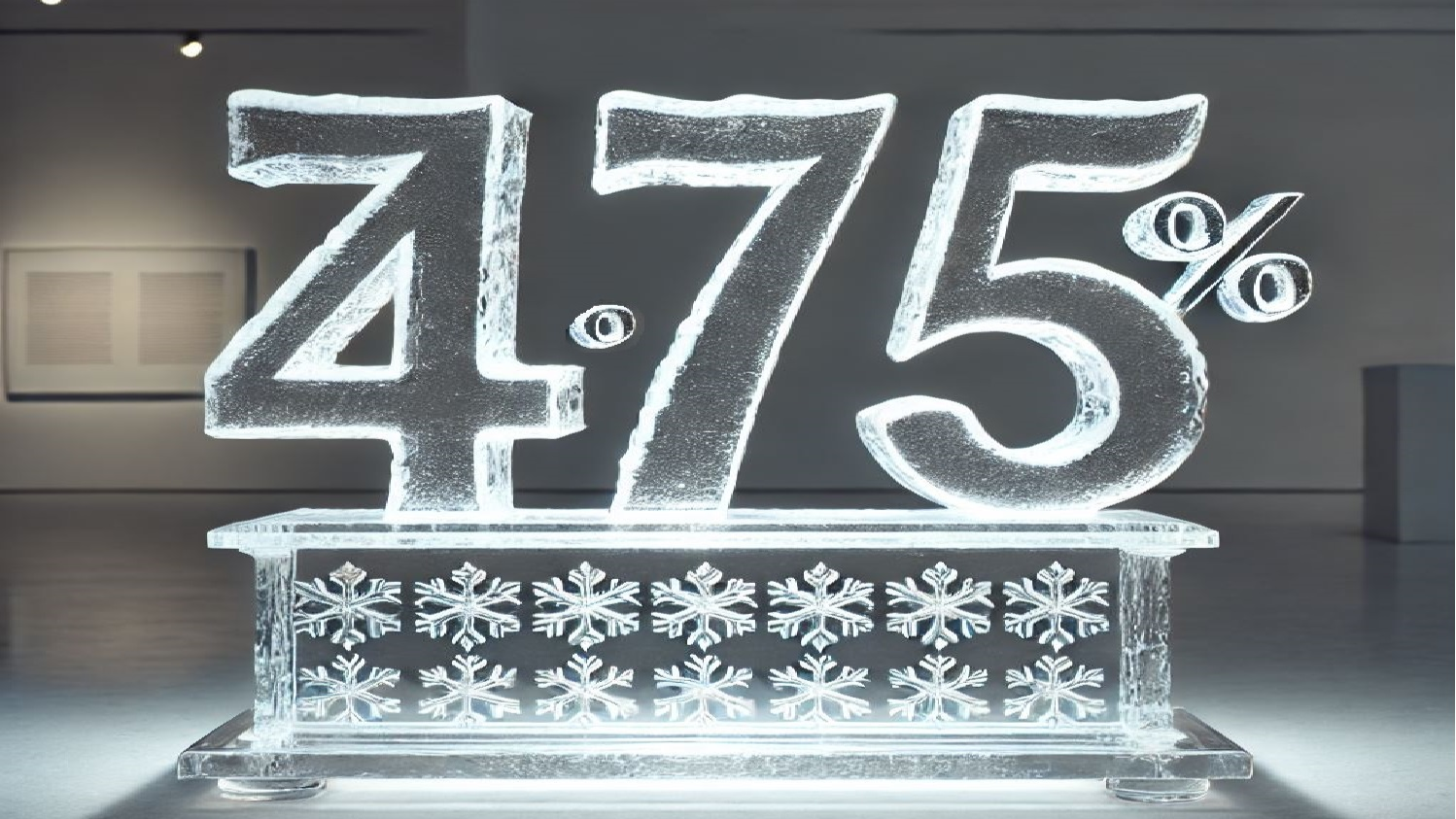

There was an early Christmas present for home buyers from the Bank of England yesterday (Wednesday) as it chose to freeze interest rates at the current 4.75%. There was concern throughout the property sector in Gibraltar that interest rates may be tweaked slightly upwards after it was revealed that UK inflation rose to 2.6% in November, above the central bank’s target.

In its final meeting of the year, the Bank’s rate-setting committee decided against any changes following recent data showing an increase in both inflation and wage growth.

The Office for National Statistics revealed yesterday that inflation in the UK had risen to 2.3% from 2.6%, pushed higher by pricier petrol and clothing.

Bank governor Andrew Bailey has previously indicated that rates may well eventually fall further – after two cuts this year – but that the decline would be gradual.

The Bank will next meet in early February when it will also give an update of its forecasts for the British economy.

Nathan Emerson, CEO of Propertymark, commented:

“With many national and international factors continuing to shape the global economy, the Bank of England is understandably taking a cautious path until they can be confident that they are able to safely reduce interest rates back. It has been encouraging to see interest rates reduced across recent months, but the base rate can only be reduced if all factors allow.

“High interest rates can of course affect borrowing for many people, especially those stepping onto the housing ladder, but it’s important there is sensible balance to keep the overall economy secure and workable for all.”

Paul Gibbens MNAEA, of Richardsons confirmed:

The news will be a welcome Christmas gift for Gibraltarian home buyers, particularly first time buyers, who have been battling with rising costs and high interest rates for a few years. Further reduction through next year will lead to more first time buyers getting on the ladder, which can only be positive for the rest of the market and shows positive signs for 2025.